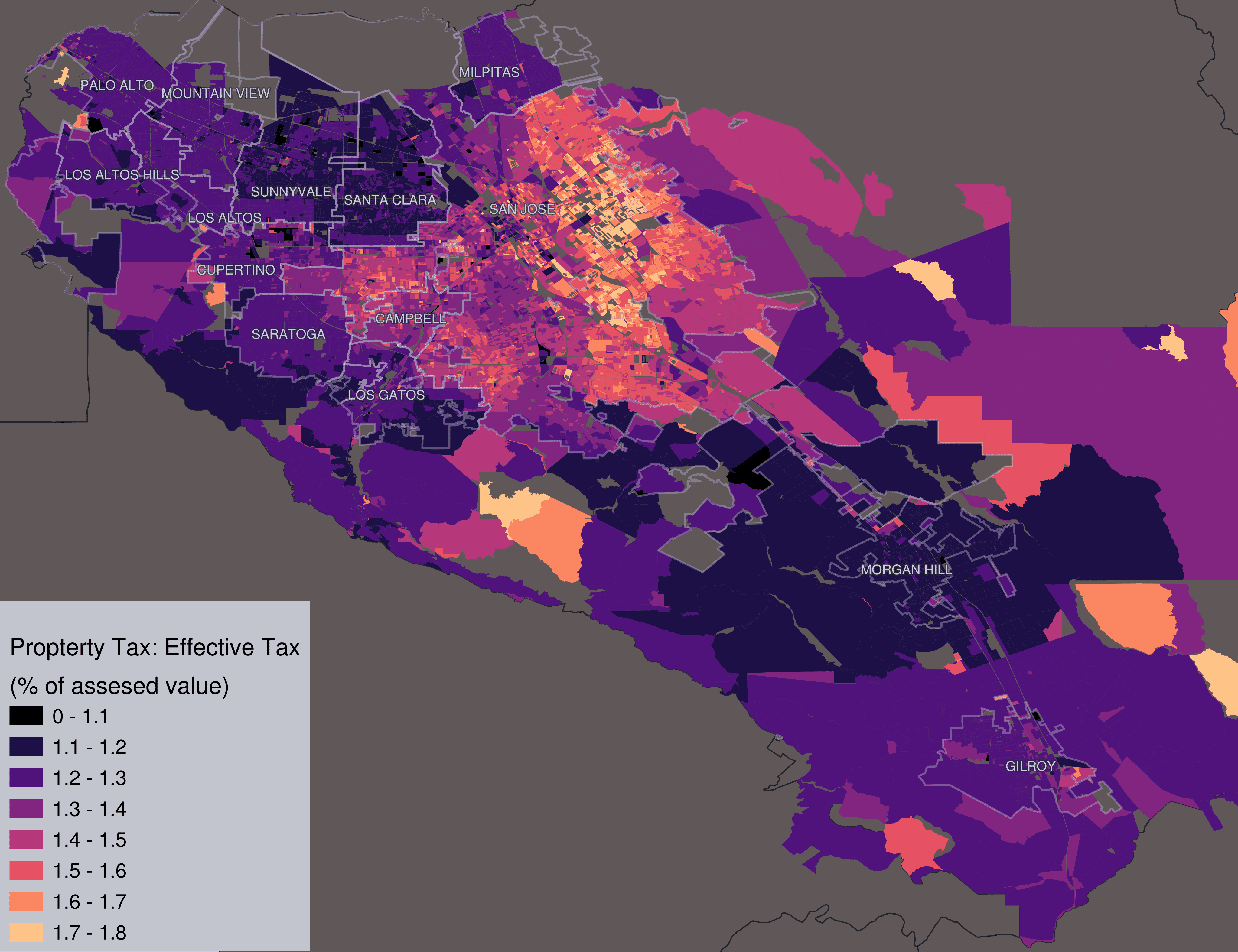

Debt Rates and Parcel Taxes in Santa Clara County

Effective Tax Rates Are Over 1%

We already talked about the 1% tax rate set by prov 13 in California. But in Santa Clara County the effective tax rate is greater.

This is because, while prop 13 makes it much harder to increase property taxes, it does not prevent this from happening. Prop 13 specifies that all new taxes must be voter approved. And (with a couple exceptions) these ballot measures must have a 2/3 majority to pass. This makes it very hard to get them approved, but not impossible.

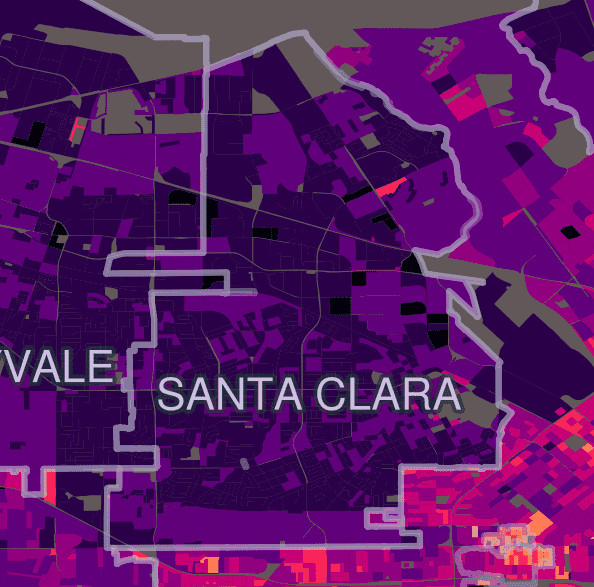

Each tax is for a specific jurisdiction (city, school district, water district, etc) and only voters in the effected district vote on the tax. An specific subset of overlapping jurisdictions is called a “Tax Rate Aarea”. For example the southern edge of the city of Santa Clara pays a slightly higher tax rate than most of the rest of the city.

That area is part of the Freemont Union high school district, and they have a special assessment other property owners in the city don’t have to pay. This assessment is a voter-approved debt.

Voter Approved Debt Rates

Voter approved debt is the most common addition to the 1% tax. One reason for this is that, unlike other taxes, general obligation bonds for school and community college facilities can be approved by just 55% of the vote. These bonds must be used for infrastructure projects, they cannot be used for operating expenses such as teacher salaries.

The are variable rate, which means the amount can fluctuate year-to-year. And once they are paid off they go away. Voter approved debt is an inconsistent and inperminant

But why does the effective tax percent vary within a tax rate area? That is because of parcel taxes.

Parcel Taxes

Parcel taxes do need a 2/3 majority vote to pass. Even so, many do manage to pass. They are not tied to the value of the property. Most are flat rate. Meaning every parcel is asses the same dollar amount, regardless if it is a single condo or a giant corporate headquarters.

But a parcel tax does not need to be flat rate. The “Safe, Clean Water” parcel tax is based on the parcel’s Impermeable Area.

An interesting new twist on parcel taxes is the 2021 court ruling on SF proposition G. The court ruled that if a tax is voter-initiated (from collection signatures) then it is not based on the “government’s authority to tax” and so the 2/3 limit from prop 13 does not apply.

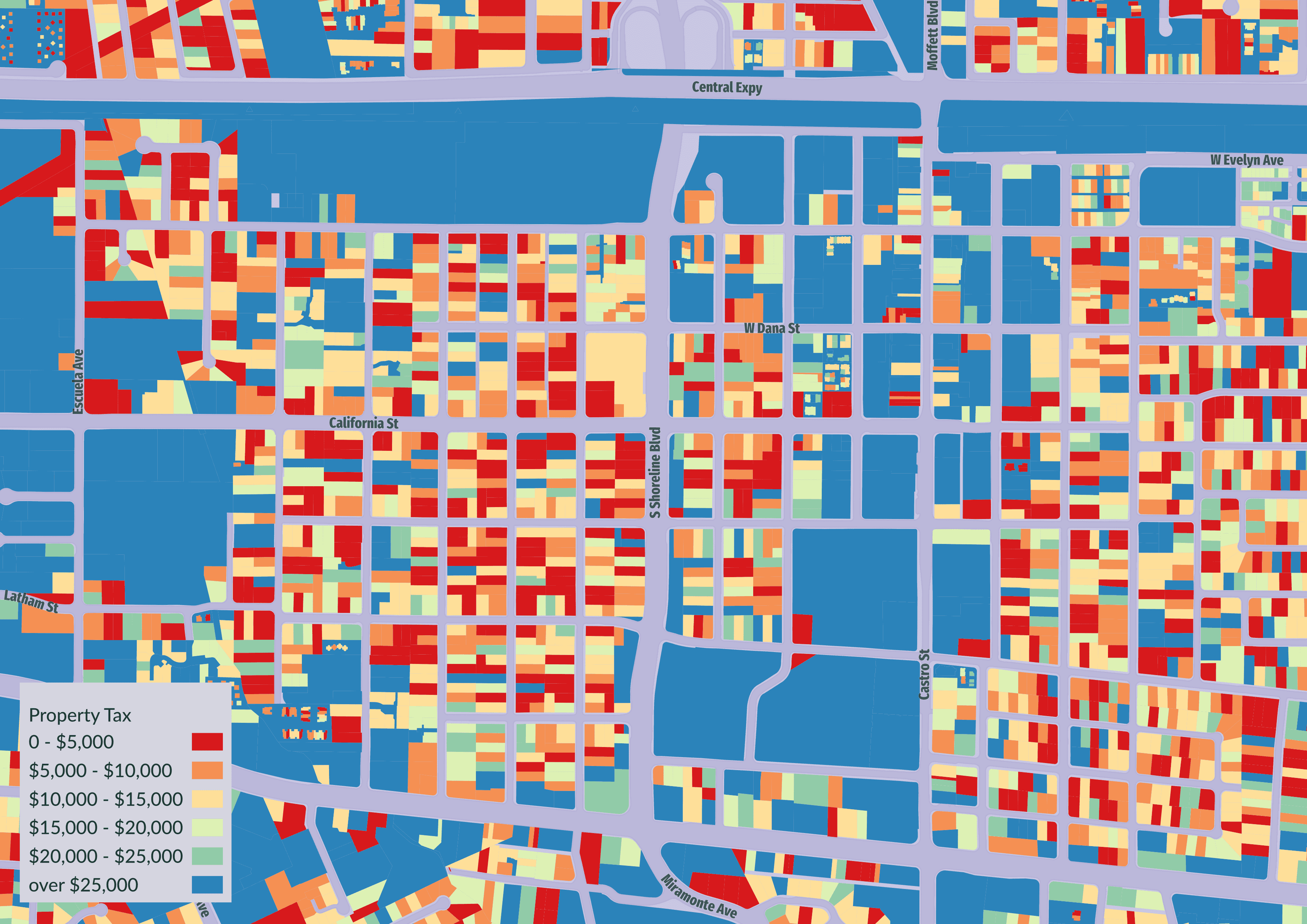

Because parcel taxes are generally flat rate, their effective rate varies wildly.

Example of a Low Rate

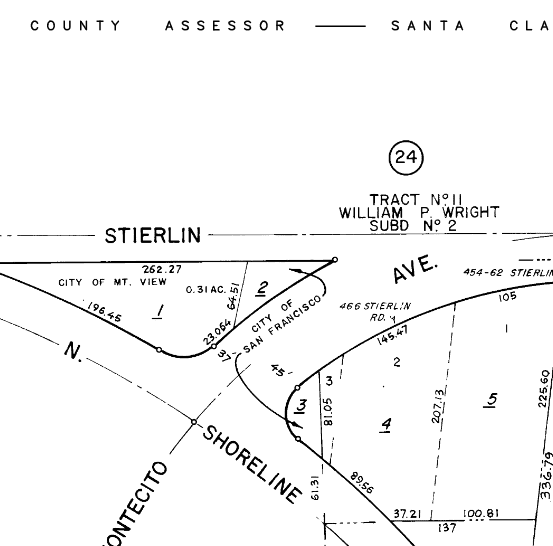

Consider parcel 153-25-002. This is a portion of an empty lot surrounded by roads. It’s assessed value is $7,807. It appears to be owned by San Francisco, and likely has never been reassessed.

So the $221 in parcel taxes add an additional 2.8% to this parcel’s effective tax rate. Bringing the effective tax rate for this parcel to around 4% of assesed value, the highest rate in the city.

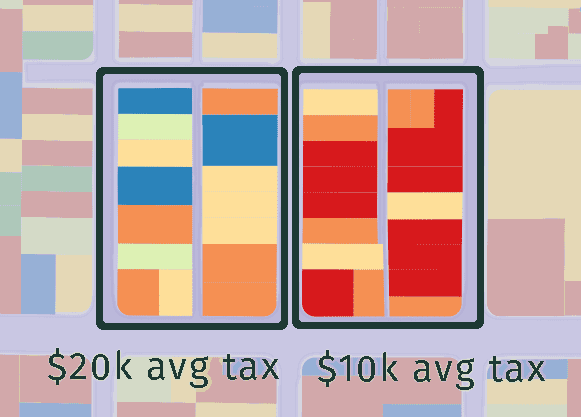

Rates Vary Within a Neighborhood

Consider two equivelent homes, one occcupeied since 1970, one just sold. The first will have much lower assesed value, and — like the parcel above — all parcel taxes will be a higher percentage of the total tax on that property. So the home occupied since 1970 will have a “higher effective tax rate” when considering the total tax.

Therefore areas with many older homes will show a higher effective tax rate than areas with mostly newer homes (or old homes with new owners). In the image above the effective tax rate for the block on the right will be .02% higher, because the $320 in parcel taxes represents a larger portion of the total tax property owners pay. This explains the variation in effective tax rate within a tax rate area.

Et Cetera

There is a bit more to the tax story, like Mello-Roos. And other exceptions to prop 13 such as to fund retirement benefits or state water projects. But 1%, debt rates and parcel taxes seem to make up the bulk of what property owners pay here in Santa Clara County.

If you are interested in more details I found this 2012 report to be a good overview.